Donating part or all of your unused retirement assets, such as your IRA, 401(k), 403(b), pension or other tax-deferred plan, is an excellent way to make a gift to United Way of Santa Barbara County.

If you are like most people, you probably will not use all of your retirement assets during your lifetime. You can make a gift of your unused retirement assets to help further our mission.

IRA Beneficiary Designation Gifts are Simple, Tax-Smart & Affordable. If you are interested in making a planned gift to United Way, but are also concerned about your current and future needs, know that IRA beneficiary designation gifts are simple, tax-smart and flexible. Talk to your financial advisor about funding legacy gifts with your traditional IRA, which is a taxable asset except when gifted to charity, while leaving other non-taxable assets to heirs.

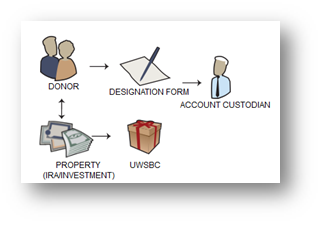

How an IRA beneficiary designation gift works:

Your IRA company will not be influenced by what your will or trust says, what your spouse or kids say, or what your trustee says. The most recent IRA beneficiary designation form signed and submitted determines who will inherit your IRA, so it is very important to make sure this designation is up-to-date.

Even after you complete the beneficiary designation form, you can take distributions from your IRA. You can also change your mind at any time in the future for any reason, including if you have a loved one who needs your financial help.

Most beneficiary designation forms are very flexible. You can name United Way of Santa Barbara County (UWSBC) as a "full" or "partial" beneficiary of your IRA. You can also name UWSBC as a "primary" or "contingent" beneficiary. Please make sure your IRA designation is current and consider a legacy gift to United Way through your IRA.

If you need help getting directions on naming beneficiaries from your IRA company or we can help in any other way, please contact us.

Did you know that 60%-70% of your retirement assets may be taxed if you leave them to your heirs at your death? As a qualified charity, United Way is not taxed upon receiving an IRA or other retirement plan assets. We can benefit from 100% of the value while your heirs may be taxed heavily on the same gift made to them.

If you want to lower your heirs' capital gains taxes, keep more money in your family and make a legacy gift to United Way, you might want to leave real estate and stock to your heirs, and give your retirement assets to United Way of Santa Barbara County

When you die, qualified stocks, real estate and other capital assets that you leave to your heirs are valued at current market value on the date inherited, avoiding capital gains taxes. In most cases, gifts of real estate and stock will be more tax advantaged gift to your heirs than gifts of retirement assets.

If you have any questions about gifts of retirement assets, please contact us. We would be happy to assist you and answer any questions that you have.

Please let us know if you have already included United Way of Santa Barbara County as a beneficiary of your retirement assets. We would like to thank you and recognize you for your gift. Your gift may qualify you to become a member of our Heritage Club.