Search IRA Rollover Custodians:

| IRA web page | ||||||||

|

Notify us of your IRA charitable rollover

If you check the box in this area, a module will open where you can enter your name and email to notify us of your IRA Rollover gift.

|

||||||||

|

|

||||||||

|

Thank you for considering an IRA charitable rollover gift to us. The website link will take you to your IRA custodian's website, where you may be able to log in and make a gift to United Way of Santa Barbara County. Another option is to use the phone number to call your IRA custodian. They will assist you in making an IRA charitable rollover gift. If you would like to notify us of your generous IRA charitable rollover, please complete the Notify us of your IRA charitable rollover section. Please note this is a time sensitive transaction. If the IRA charitable rollover is intended to satisfy your required minimum distribution for the current year, verify with your custodian that this transaction will be completed prior to December 31. If the transaction is not completed prior to December 31, you may be subject to penalties if you have not satisfied your required minimum distribution. |

||||||||

| Your Name | ||||||

| Your Address (Street or P.O. Box) | ||||||

| Your ZIP | ||||||

| Notify us of your IRA charitable rollover | ||||||

|

||||||

| Thank you for considering a IRA gift to us. A sample letter is available to send to your DAF provider. You may save and print the PDF of your letter. If you have email contact information for your DAF provider, you may send a PDF copy of your DAF letter or you may copy and paste the text into an email. You will need to enter the amount of your recommended grant and your DAF account number on the letter before mailing. If you would like to notify us of your generous gift, please complete the Notify us of your DAF Gift section. | ||||||

Tax-Wise & Medicare-Wise Charitable Giving Today

2023 UPDATE (SECURE ACT 2.0) - Starting in 2023, the age for required minimum distributions (RMDs) will increase from 72 to 73. The RMD age will increase again in 2033 to age 75. Individuals who are currently taking RMDs will continue to take a distribution each year based on their age.

The law remains that IRA owners age 70½ and older can make a charitable rollover gift of up to $105,000 from their IRA to public charities. This charitable IRA rollover will count toward their RMDs.

| May satisfy your annual required minimum distribution (RMD) up to the amount of the gift | |

| Reduce your taxable income, even if you do not itemize deductions, because it allows you to give from pre-tax assets and your distribution is excluded from taxable income | |

| May prevent you from being pushed into a higher tax bracket or higher Medicare Part B or Part D premium bracket because the gift reduces your taxable income. | |

| Helps avoid limits on charitable deductions | |

| Minimizes the effect your giving has on your cash flow because the gift is from your assets (your IRA), not your check book |

If you are at least 70 1/2, you can make annual charitable gifts through your IRA. At your direction, your IRA custodian will transfer the gift you designate directly from your IRA to a qualified charity. This is known as a Qualified Charitable Distribution, or QCD.

IRA Beneficiary Designation Gifts are Simple, Tax-Smart & Affordable. If you are interested in making a planned gift to United Way, but are also concerned about your current and future needs, know that IRA beneficiary designation gifts are simple, tax-smart and flexible. Talk to your financial advisor about funding legacy gifts with your traditional IRA, which is a taxable asset except when gifted to charity, while leaving other non-taxable assets to heirs.

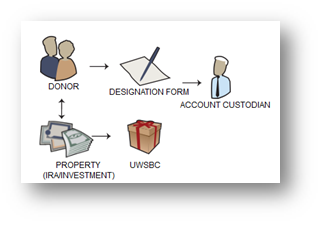

How an IRA beneficiary designation gift works:

Your IRA company will not be influenced by what your will or trust says, what your spouse or kids say, or what your trustee says. The most recent IRA beneficiary designation form signed and submitted determines who will inherit your IRA, so it is very important to make sure this designation is up-to-date.

Even after you complete the beneficiary designation form, you can take distributions from your IRA. You can also change your mind at any time in the future for any reason, including if you have a loved one who needs your financial help.

Most beneficiary designation forms are very flexible. You can name United Way of Santa Barbara County (UWSBC) as a "full" or "partial" beneficiary of your IRA. You can also name UWSBC as a "primary" or "contingent" beneficiary. Please make sure your IRA designation is current and consider a legacy gift to United Way through your IRA.

If you need help getting directions on naming beneficiaries from your IRA company or we can help in any other way, please contact us.

Many people have Donor Advised Fund (DAF)s which allow them to donate assets for charity today – and receive a tax deduction now – even though the actual funds are not granted by the donor to the final charity until some point in the future. DAFs can be used to make current gifts and future gifts.

Learn more making a gift to United Way of Santa Barbara County through your existing DAF.

Your message has been sent.